ASX was up this week, +0.7%. Lithium stocks did especially well this week helping the market higher.. Here is a selection with rises for the week: Arcadium Lithium +19.9%, Pilbara +10%, Mineral Resources 6.94%, IGO +11.39%. Not bad – but Uranium stocks did even better, Silex Systems +24,63%, Boss Energy +21.23%. All those stocks, however, represent a small part of the market. The best performing sector this week was Real Estate (XPJ) +3.14%. If Real Estate is doing well, it usually means investors are sniffing a rate cut in the air.

Let’ not get ahead of ourselves.

First, the daily chart for the XJO.

XJO has been respecting horizontal support at around 7567 since 19 April. That seems to be a major level for the bears to overcome. XJO was up four out of five days, but the one down day (Wednesday) was a big supply day which wiped out all of the gains on Monday and Tuesday.

Big supply days (selling days) have been a feature of the market now for the past two weeks. Every time the XJO manages a rebound, the bears come in and sell the market back down. But they haven’t been able to break horizontal support, so far.

All indicators remain in their bearish zones. We have to presume that the bears have control until we see a higher high and a higher low.

Meanwhile the American market is on the threshold of breaking its bearish sentiment.

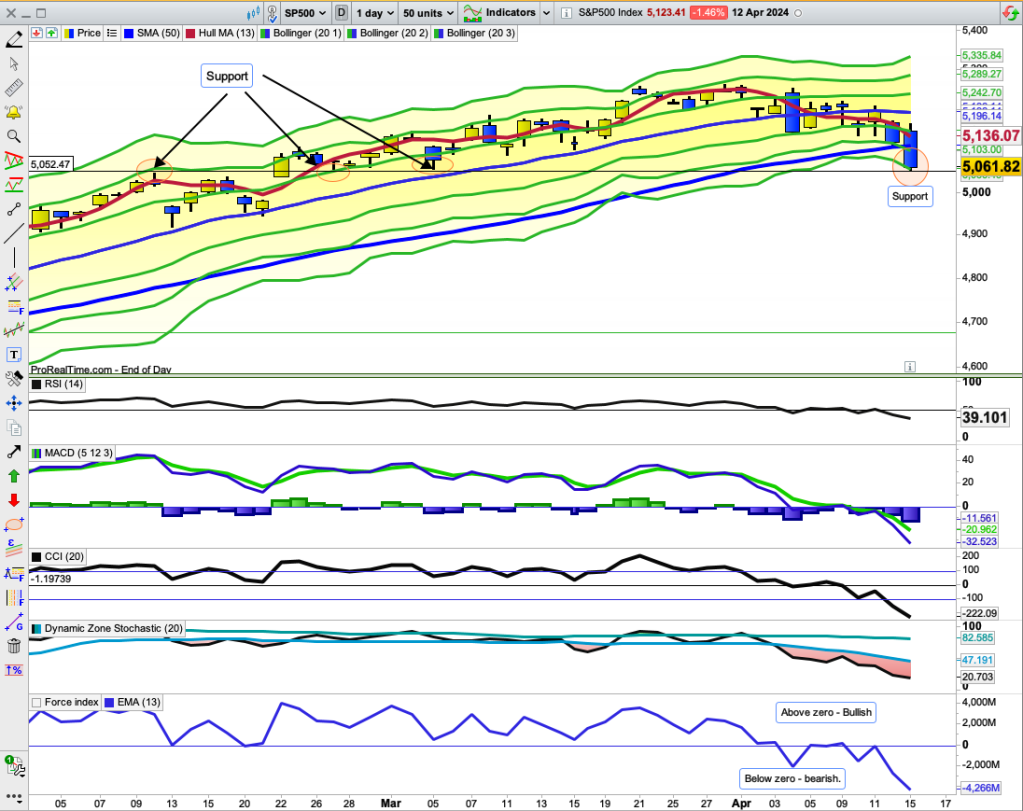

SP500

SP500 jumped out of the blocks on Friday after a poor Jobs Report – the market assuming that means the prospect of lower interest rates. After that great start to the day – that’s more or less where the index finished the day – stymied by dynamic resistance of the 50-Day MA. That needs to be overcome for the market to prove its bullish credentials.

All indicators except the Detrended Price Oscillator (DPO) are back in their bullish zones – that’s a plus.

You’ll not that this is not the first time that SP500 has butted up against the 50-Day MA. It may not be the last time.

The Australian market will, no doubt, follow the U.S. higher on Monday but will surely be unable to establish a new bullish mark. Sydney Futures for Monday are up +0.29%, ensuring a positive start to trading on Monday.

The Australian market is in the midst of Reporting Season. Two notable misses this week were Macquarie and Woolworths. Macquarie was down -2.22% on Friday and continues to respect its down-trending 20-Day MA, which is much lower than its 50-Day MA. That’s a recipe for further downside.

Woolworths missed on Thursday and fell -4.15% and set a new 52 Week low. How much lower? Incongruously, WOW continues to be bashed for price gouging in the press and in the Senate. Beats me.

Sector Performance sthis week.

Best performer this week was Property (XPJ) +3.14%. That’s an interest rate sensitive sector. The next two best performers were also interest rate sensitive stocks, Technology (XIJ) +2.31% and Discretionary (XDJ) +2.14%. Those figures are telling a story – and that was before the Jobs Report on Friday in America, which hinted at further interest rate drops.

The worst performers were Staples -2.28% and Energy -1.81%. Staples was, of course, impacted by the big fall in WOW. Energy has been in a long down-trend, and WDS is now setting new 52-Week lows. I keep watching for a turn-around in Energy – but it still remains stubbornly bearish.

XEJ Daily

The sell-down in Energy has been unrelenting since early April. Friday saw the first bullish engulfing candle since 11 April. That’s an indication that some demand is returning to the Energy Sector. But we need to see a lot more before concluding that his downtrend is over.

Positive Divergences on CCI and DZ Stochastic also hint at a possible turn-around. But we have to see more positive price action.

Sector Performance – last four weeks.

The above graph shows the performance of the eleven ASX sectors + corporate bonds over the past four weeks.

The items are divided into three groups:

- Growth Group: Materials, Discretionary, Financials, Property.

- Sensitive Group: Telecommunications Services, Energy, Industrials, Information Technology.

- Defensive Group: Staples, Health, Utilities, Composite Bonds.

This is a handy way of showing the mind-set of Investors, particularly the large investors who determine the direction of the market.

All groups are down, but the best relative performer is the Cyclical Group -0.21%.

Second was the Defensive Group -0.89%.

Third was the Sensitive Group -3.37%

Until we see both the Cyclical and Sensitive Groups out-performing the Defensive Group, the mind-set of Investors is definitely on the bearish side. This week has made a start in that direction

% of stocks above key Moving Averages. 200DMA, 50DMA, 10DMA

All three metrics lifted this week – that’s a good start, but % Stocks below 50-DMA and 20-DMA remain in bearish territory – below the 50% mark. But that could easily crack in the next week if the favourable move in stocks continues.

Long-Term Investment Indicator

My Long-Term Investor Indicator is based on New Highs minus New Lows Cumulative. While the NH-NL CUM line remains above its 10-Day MA, the Long-Term Investor can maintain their bullish positions.

This indicator, which is a lagging indicator, went bullish in mid-December and has remained bullish since then despite the recent pull-back. On only one day, so far, has NH-NLs shown a negative number, but the NH-NL Cum line is getting perilously close to its 10-Day MA. It wouldn’t take much to throw it into negative territory.

This indicator trends very strongly. When it does change direction from bullish to bearish, the change should be carefully noted. and action taken.

Conclusion.

There have been positives this week in sections of the market, notably, Lithium, Uranium and Property. But despite the positve result in the XJO this week, we still need to see further upside before concluding that the bearish pull-back is over. It could just as easily roll-over as go to the bullish side.

Warren Buffett held his annual Berkshire-Hathaway Meeting this week-end. Investors hang on his lips for every word from the “Oracle of Omaha” – not that there is anything which would help anybody in their investment decisions. It is always ex post facto. Nevertheless, it always provides interesting reading if you’re having a slow Sunday. Highlights from CNBC can be read here.