I had to feel for the leader writer on CNBC last night. Soon after the opening in the U.S. he wrote (this is a paraphrase):

Dow surges more than 300 points on the back of good retail figures overshadowing the Israel/Iran conflict.

A few minutes later he wrote (paraphrase):

Dow surges more than 200 points on the back of good retail figures overshadowing the Israel/Iran conflict.

A few minutes after that he wrote (paraphrase)

Dow surges more than 100 points on the back of good retail figures overshadowing the Israel/Iran conflict.

Soon after that the Dow was nudging zero for the opening session

The poor guy, even though the Dow had fallen 200 points from the opening, he couldn’t give up his natural optimism that the Dow was “surging”.

The Dow finished down about -250 points and it was the best of the three major indices.

Dow Jones -0.65%. SP500 -1.2%. Nasdaq -1.79%. Small Caps -0.89%. Surprisingly, Banks survived the carnage, +0.3% but suffered from plenty of intra-day selling.

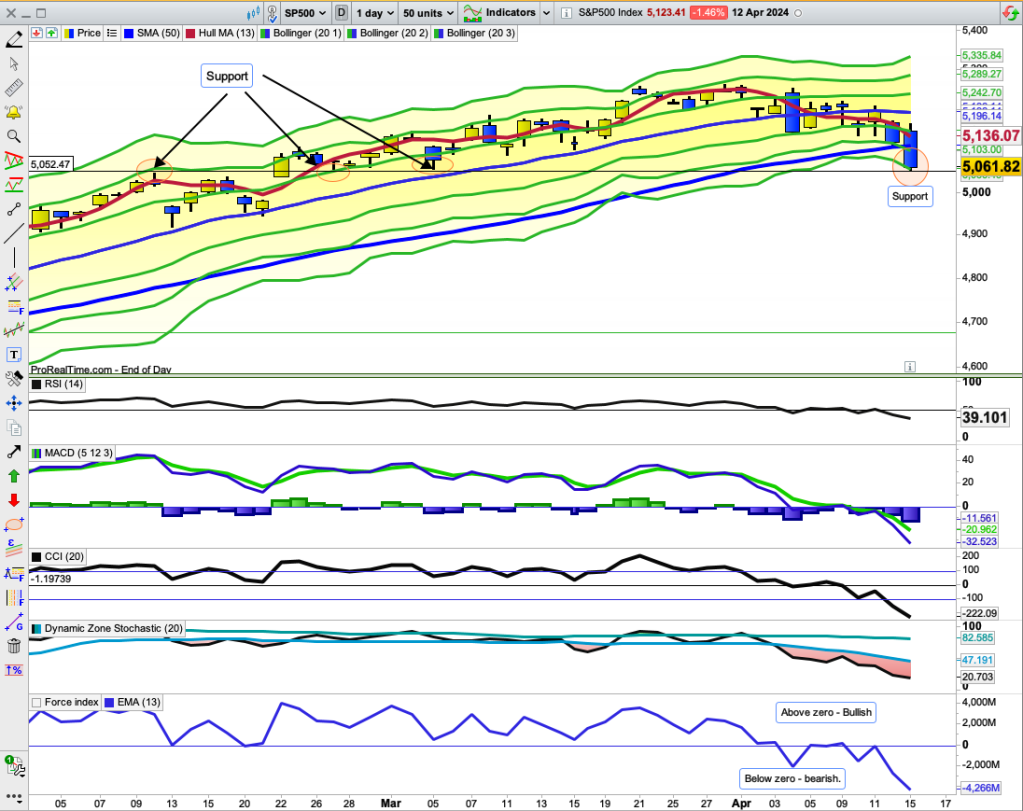

SP500.

SP500 is now down three standard deviations from the 20-Day MA. That’s getting a bit extreme. Plus it has reached a major support level. So we may see a bounce here in the SP500. But, Bears have the upper hand for now. The 50-Day MA and 20-Day MA both present as possible resistance levels. Look for a fall after hitting one of those.

The mantra has now changed from “buy-the-dip” to “sell-the-rally”.

This may, of course, just be a knee-jerk reaction of Middle East events and we will see a V shaped recovery. I think, however, that the context of a re-acceleration in inflation makes that less likely. The current fall has been brewing for some time.

Commodities.

Commodities Index +0.13%. Energy -0.23%. Base Metals +1.44%. Agriculture +0.9%. Gold +1.87%.

Ozzie Futures are well down overnight guaranteeing a weak opening. SPI -0.81%

Good luck.