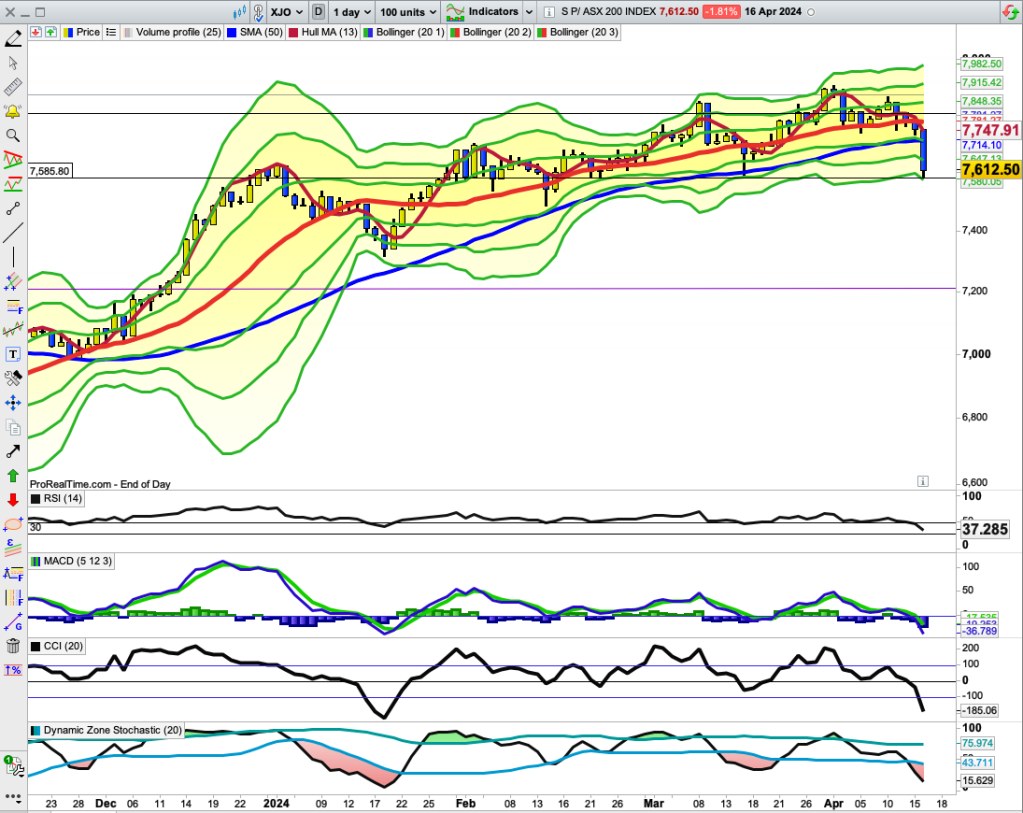

XJO down heavily today, -1.81%.

The technical picture for XJO is similar to the picture for SP500 shown in my morning report.

The Index is down to 3 Standard Deviations below the 20-Day Moving Average. Support exists at the low of today from the low set back on 15 March. Back on 15 March, however, the index bounced sharply off support, where today the index finished without any significant bounce.

All indicators are currently bearish.

A little bit of intra-day buying was seen in the afternoon session, but not enough to think we’re about to see a substantial reversal.

Given the size of today’s downside move and the fact that it is at horizontal support, we probably will see a bounce tomorrow – but if it doesn’t amount to much, then the bears remain in control.

I have to presume that the current down-trend is the dominant feature and that rallies will be sold into – until we see signs of a definite change in the trend.

There were few places to hide today. All sectors were down. The best, relatively, was Telecommunications -1.03%. That’s cold comfort as Telstra, which is the largest stock in the sector, hit a 52-Week low today.

Worst performer today was Discretionary -2.39%.

The biggest Sectors in our market are Financials, down today -1.92%, and Materials -2.03%. both poor results.

In early European trading, Euro STOXX600 is down heavily -1.4%.

Dow Futures -0.13%. Nasdaq Futures -0.12%. Those American Futures give some promise of a respite in the downside movements.

Ozzie Futures are flat at -0.01%.

Good luck.