Dow Jones +0.17%. SP500 -0.21%. Nasdaq -0.12%. Small Caps -0.58%. Banks -1.63%.

Trading was mostly turgid during the session except for one moment of brightness in the major indices around 2 p.m. (NY time). Major indices suddenly short higher with the Dow going up from nothing to +0.65%, then just as suddenly sinking back to nothing. I looked around for a “reason” – couldn’t find anything. Must have been a “fat finger” mistake.

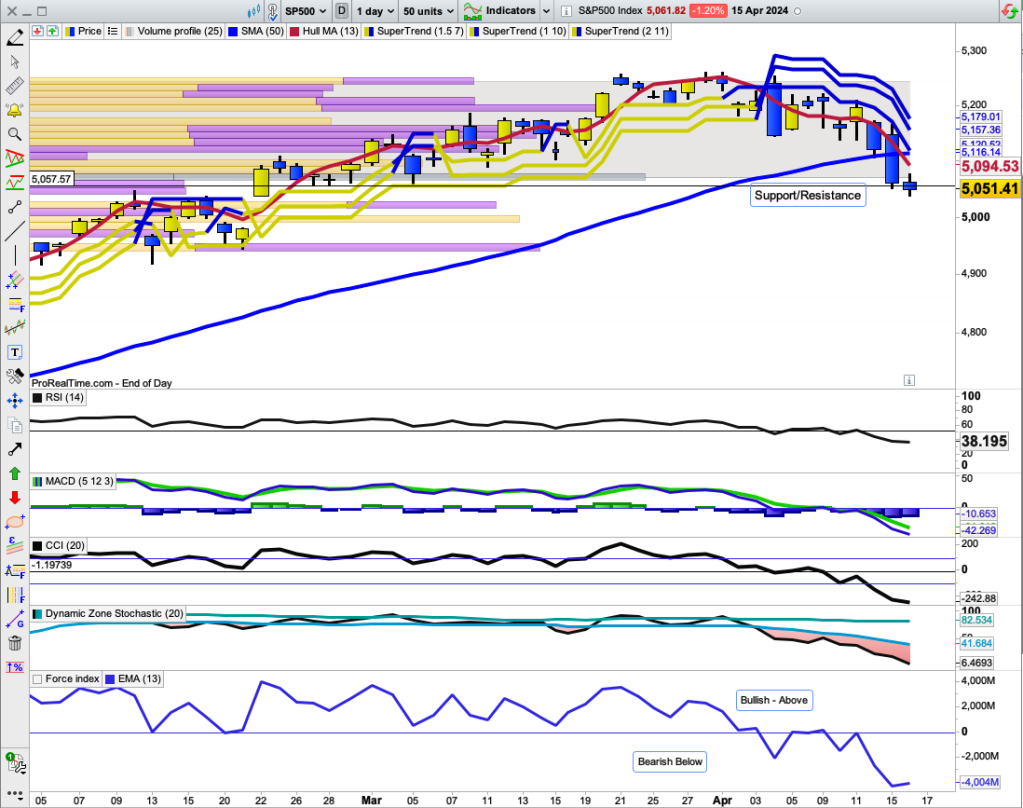

SP500.

It’s now six days since the bery narrow range candle on 8 April. Last night’s candle was the narrowest in the past six days – so we might be close to a bounce higher here.

The body of last night’s candle finished straddling the major support/resistance line shown on the chart – which suggests a possible short-term end to this run down.

DX Stochastic is in the very oversold zone below 20. It finished this session at 6.47. A move higher above 20 might signal a sustainable bounce. But I’m still expecting the sell-the-rallies mantra to be the major sentiment ruling action.

Commodities.

Commodities Index -0.17%. Energy +0.14%. Base Metals -0.91%. Agriculture -2.3%. Gold -0.12%.

After a few minutes of trading this morning, XJO is down marginally -0.01%.

Today might be a day when short-term traders take a long position trying for a quick profit.

Good luck