Is this a bear market?

It depends on how you want to define it. Here are three different definitions:

- The market falls more than 20%. (Usually accepted definition)

- The market falls more than 10%. (Sometimes called a correction.)

- Investors become risk averse. (Subjective assessment.)

The first two are objective criteria – and the current market doesn’t meet the criteria. SP500 is down -5.9% since the end of March. Dow Jones down -5.66% from the end of March till Wed. 17 April. XJO down -5.28% in the same time.

The third criteria is subjective. Given the current down trends in major indices – I think we can say investors are risk averse. CNN’s Fear and Greed Index is now in the Fear section of their guide.

If we look at some well known stocks in the U.S. Market, Tesla is down -29% since the beginning of March – its in a bear market. Boeing is down more than -40% since the beginning of 2024.

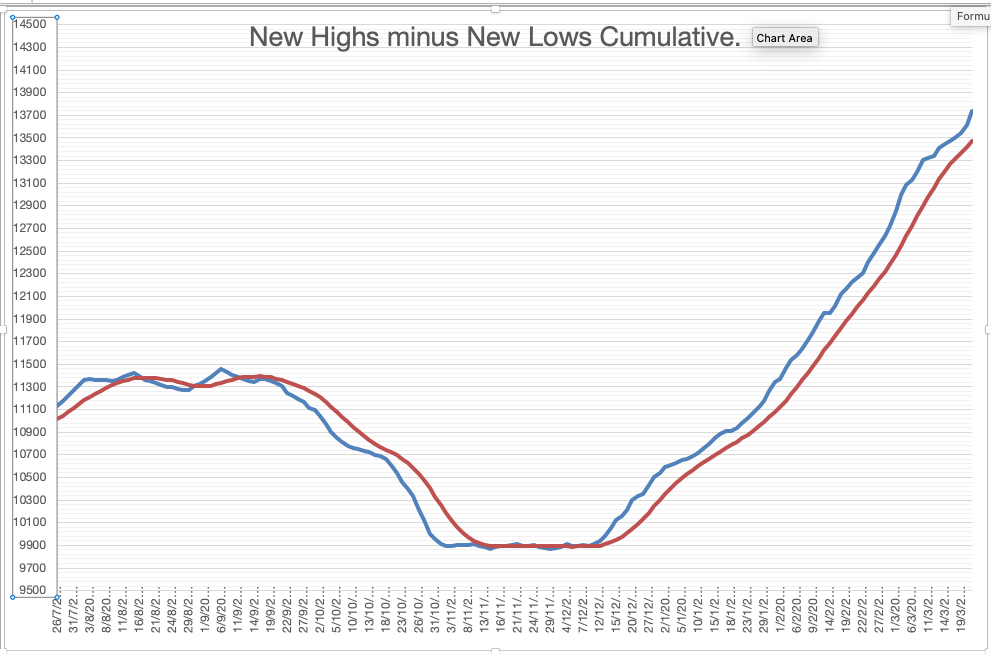

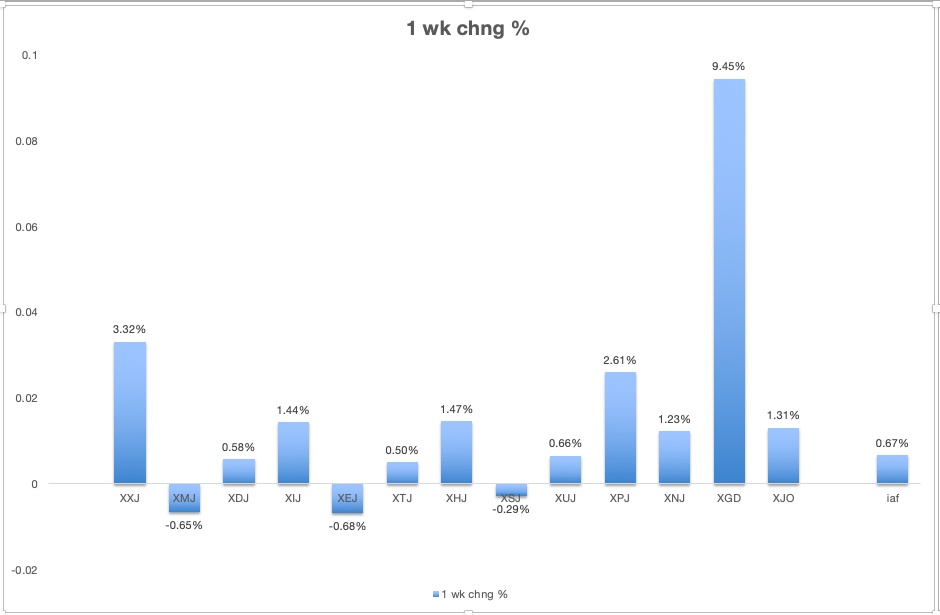

Another way of assessing investor attitude to risk is to compare the performance of the three groups of sectors I use:

- Growth Group: Materials, Discretionary, Financials, Property.

- Sensitive Group: Telecommunications Services, Energy, Industrials, Information Technology.

- Defensive Group: Staples, Health, Utilities, Composite Bonds.

Performance of the three groups over the past month:

- Growth Group, -3.63%.

- Sensitive Group, -3.35%.

- Defensive Group, -0.65%.

The Defensive Group has performed considerably better (although negative) than the Growth or Sensive Groups which are both down ~3%, while the Defensive Group is down just -0.65%. That’s fairly good evidence that there’s been a shift out of risky assets into defensive assets. Investors have become risk averse. Fear has become the dominant factor in investors’ psyche.

XJO Daily Chart.

(The above chart uses PRT Bands, which shows the XJO entering a medium-term bullish market from 6 December, 2023, until 16 April. The chart is now medium-term bearish from Tuesday, 16 April.)

XJO fell heavily on Friday, down -2% intra-day, then rebounded to be down -0.98%. It regained about half the losses during the first part of the day’s trading. That’s an impressive performance – made more important by its rebound off horizonal support set in mid-February.

On 14 February, XJO fell -1.52% intra-day, then finished down -0.74%, i.e., it regained about half the original loss. That’s similar to the performance on Friday by the XJO (although the magnitude was a little greater).

14 February proved to be a short-term low which led on to a substantial bullish rally.

That could happen again now for the XJO. The big difference between the two situations is the 50-Day Moving Average.

The 50-Day MA is one of the key MAs watched by big institutional investors. (20DMA and 200DMA are two others).

In February, the XJO was above the 50-DMA, so investors had encouragement to re-enter the market.

Now, the XJO is well below the 50-DMA, so the same mind-set may be absent in this situation.

We will probably see a rebound here. Whether or not this is the end of the pull-back from the end of March is unknowable. If, however, any rally is sold into and another leg down occurs – then bear market conditions continue to apply.

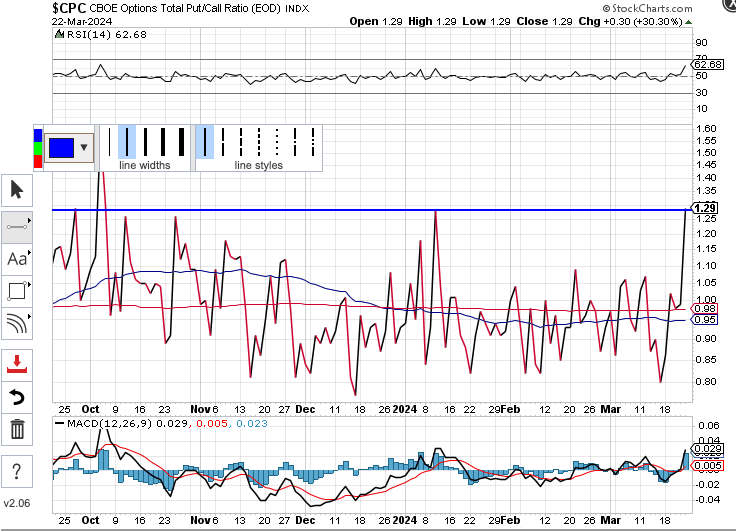

Watch what happens to RSI14. If the market begins to fall again as the RSI14 reaches 60 – then it’s best to assume bear market conditions.

Bear Market Tactics:

- If RSI14 is above 60 – assume the market is overbought and will fall.

- If RSI14 is under 40 – assume the market is oversold, a bounce will probably occur and it will be a “bear trap”.

Good luck.