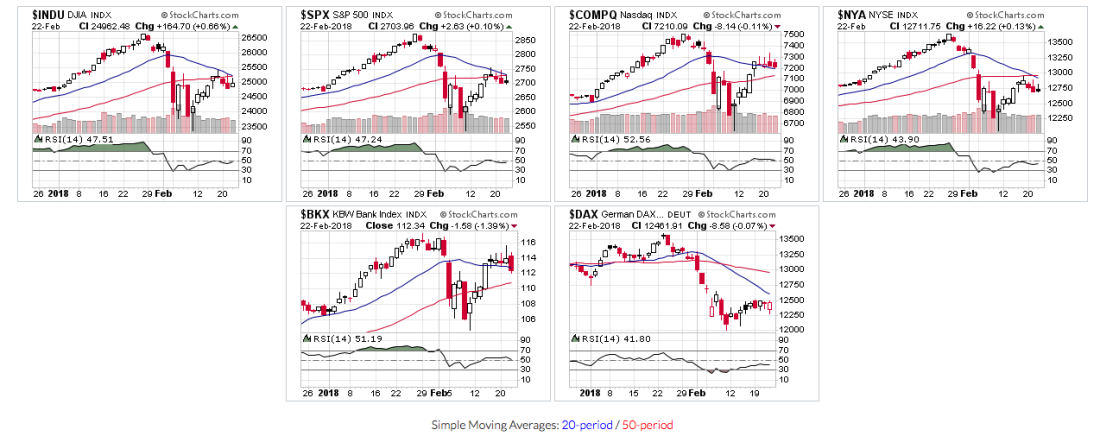

Overnight:

Dow Jones +0.66%. SP500 -0.1%. Nasdaq -0.11%, NYSE +0.13%, Banks +-1.39%, DAX -0.07%.

We can see in the INDU and SPX charts an imminent x-over of the 20-Day MA below the 50-Day MA. It has already occurred on the NY Composite (NYA). This is known as a “death cross” which supposedly leads to a correction and possibly a bear market. Does it? Yes and no. Depending on conditions. If the Indices fall away from the “death cross”, then the dire prediction will probably eventuate. If, however, the indices shoot up through the “death cross”, then the market does a Lazarus and goes on to higher points. At the the moment the charts of those three indices seem to be setting up a bull flag which usually breaks to the upside. It’s no sure thing, but the probabilities are more to the upside than the downside.

So watch which way these indices break.

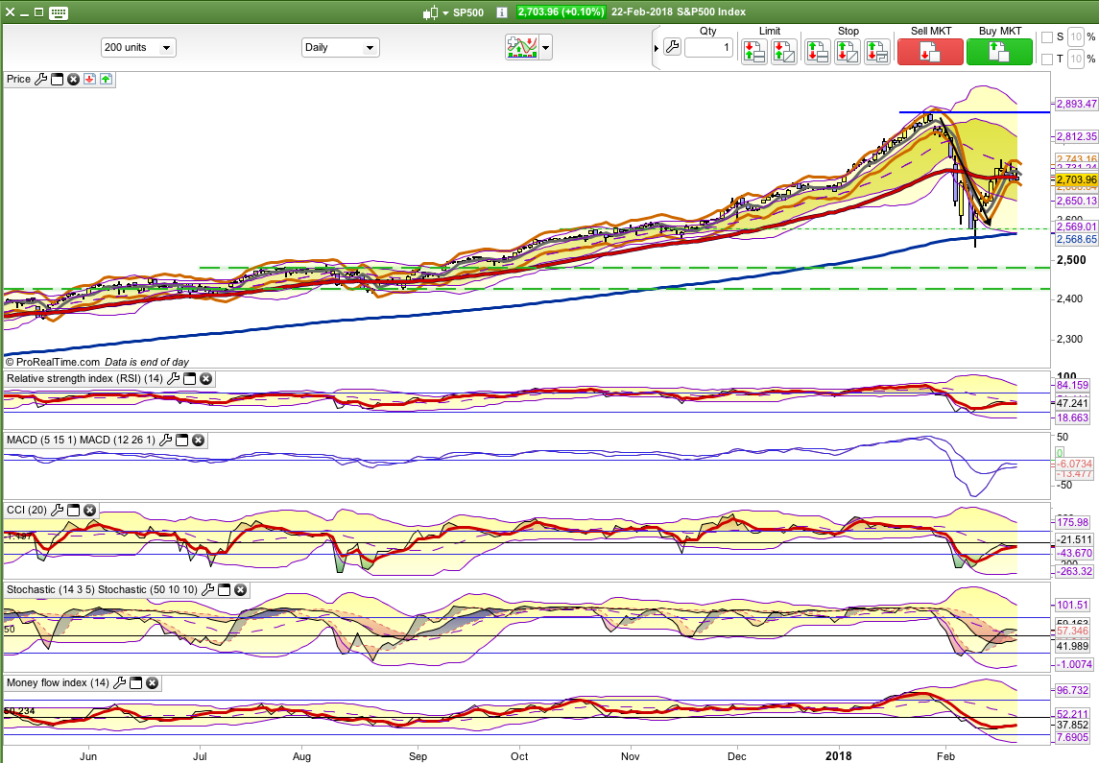

SP500

For the fourth day in a row, the 20-Day MA has proven to be a brick wall.

The trend channel has turned down. Respect the trend. Be defensive.

As noted above, we have to wait and see which way this breaks.

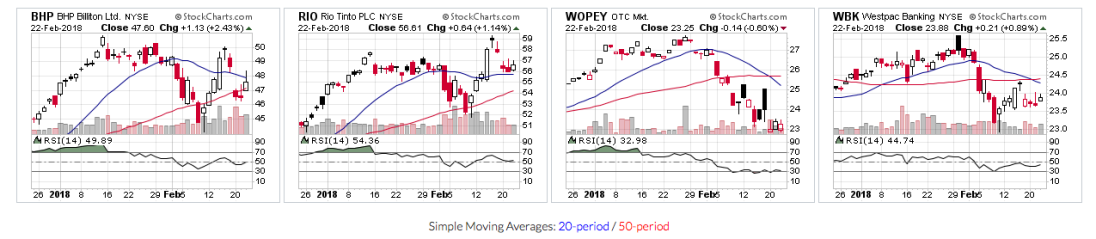

Commodities:

Commodities: DBC +0.9%. Energy +1.32%. Gold+0.51% and Industrial Metals +0.2%. Copper Producers +1.06%. Iron Ore -.3%.

Australian Stocks in the U.S. market

BHP +2.43%, Rio +1.14%, Woodside -0.6%, Westpac +0.89%.

The mining stocks had good rises but we can see similar bearish conditions (death cross) possibly setting up on BHP. They have already occurred for WBK without resolution. Woodside is bearish.